Irs Form 941 2024 Where To File. Additional tips for streamlining form 941 filing. Irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks.

This guide provides the basics of the 941 form, instructions to help you fill it out, and where you can get help meeting all your payroll tax obligations. Employers who own and operate a business with employees need to file irs form 941 quarterly and are responsible for withholding federal income tax, social security tax, and medicare tax from each employee’s salary.

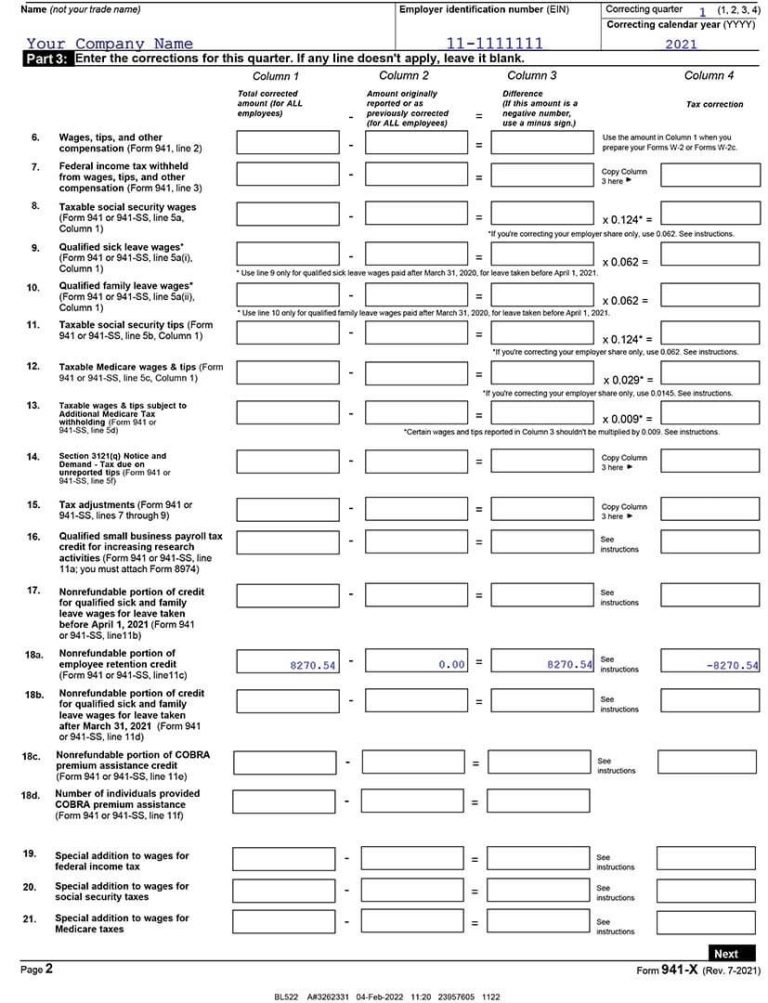

There Are Some Significant Changes To Form 941 For 2024 That Employers Must Know Before They File 941 For Their Business.

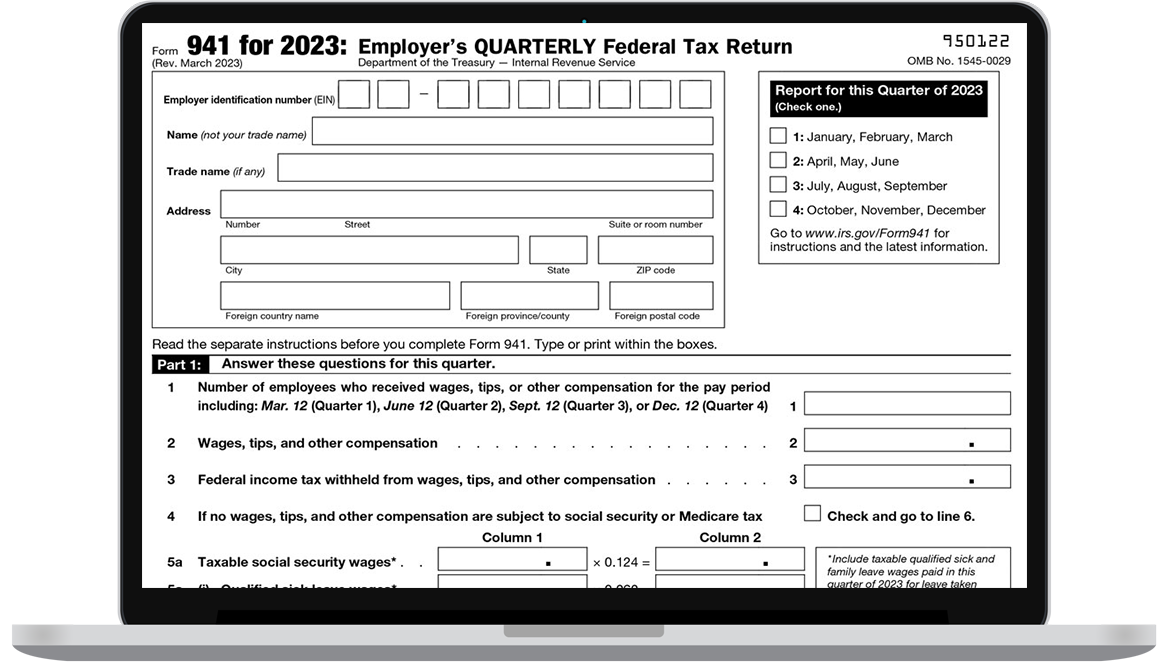

Federal tax form 941, employer’s quarterly federal tax return, is the form employers use to report employee wages and payroll taxes.form 941 contains information about the withholding made from employee wages, as well as the employer contributions made for social security and medicare taxes.

If You Operate A Business And Have Employees Working For You, Then You Likely Need To File Irs Form 941, Employer’s Quarterly Federal Tax Return, Four Times Per Year.

Irs form 941, employer’s quarterly tax return, is used to report employment taxes.

Irs Form 941 2024 Where To File Images References :

Source: www.dochub.com

Source: www.dochub.com

Form 941 fillable Fill out & sign online DocHub, After filing your itr, you need to verify it.this can be done electronically using aadhaar otp, net banking, or by sending a signed physical copy to the centralised processing centre (cpc). You must file form 941 unless you:

Source: nicolettezbrooks.pages.dev

Source: nicolettezbrooks.pages.dev

Irs Form 941 Schedule B 2024 Kore Shaine, Irs form 941, is a quarterly form that any business owner with employees must file it with the irs. In 2024, the social security and medicare tax will apply to household employees who are paid $2,700 or more and election workers who receive $2,300.

Source: www.currentfederaltaxdevelopments.com

Source: www.currentfederaltaxdevelopments.com

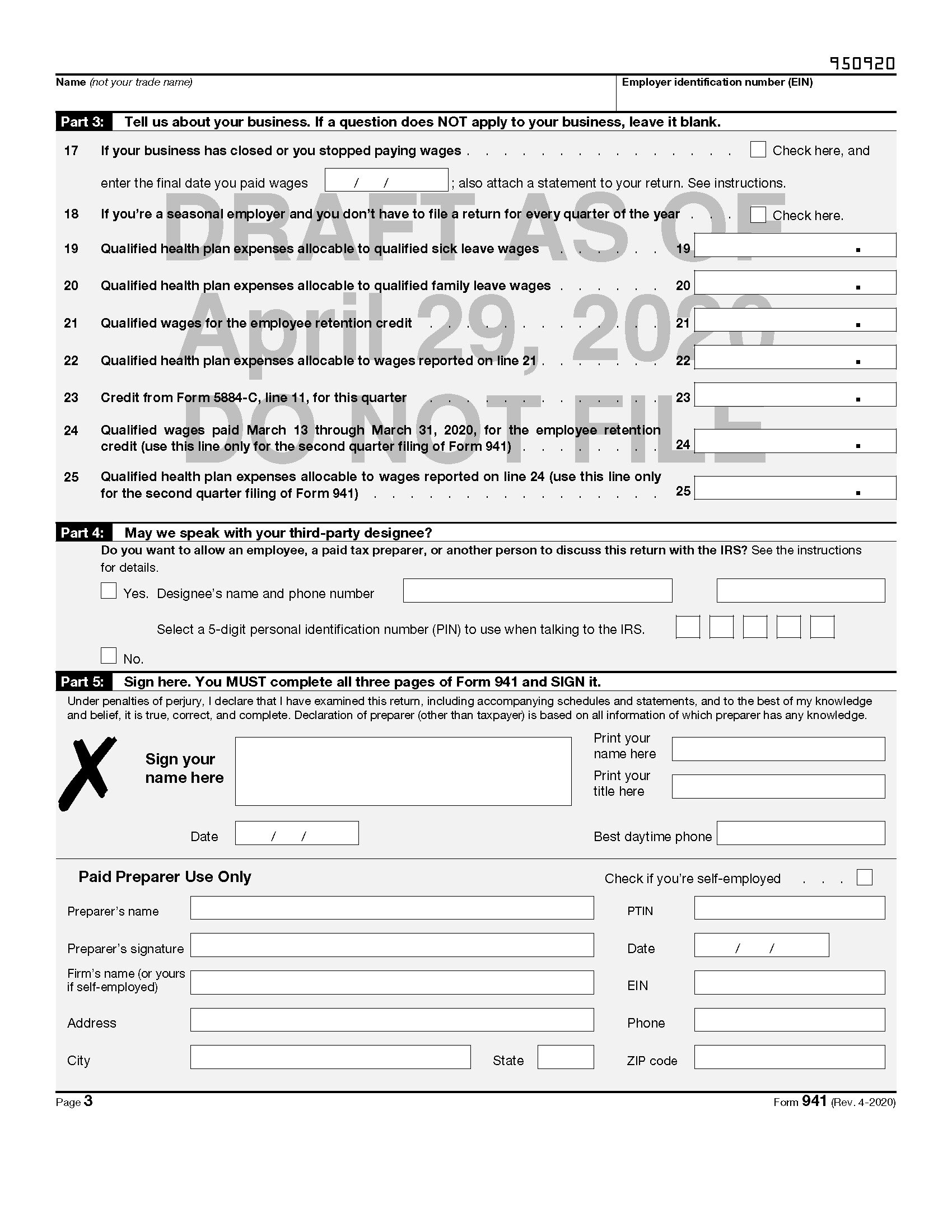

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES, Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine. The social security wage base limit for 2024 has been increased from $160,200 to $168,600.;

Source: rozellewaurlie.pages.dev

Source: rozellewaurlie.pages.dev

941 Quarterly Form 2024 Teddy Gennifer, Employers must file this irs form by july 31. If you have paid more tax than your actual tax liability, you are eligible for a refund.here’s how you can claim it:

Source: www.taxuni.com

Source: www.taxuni.com

941 Form 2023 2024, Irs form 941, is a quarterly form that any business owner with employees must file it with the irs. Irs form 941, employer’s quarterly federal tax return.

Source: 941.tax

Source: 941.tax

File 941 tax form online for 2023 Efile IRS 941 tax form, This form is also used to calculate the employer's portion of social. Lines 13a to 13i have been removed from form 941 for 2024, according to the irs.

Source: greerfionnula.pages.dev

Source: greerfionnula.pages.dev

Form 941 2024 Printable Form Dyana Goldina, Irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Just enter the required information, review the form, and transmit it directly to the irs.

Source: www.taxuni.com

Source: www.taxuni.com

IRS Fillable Form 941 2024, Lines 13a to 13i have been removed from form 941 for 2024, according to the irs. Just enter the required information, review the form, and transmit it directly to the irs.

Source: antheqkamila.pages.dev

Source: antheqkamila.pages.dev

Irs Form 941 2024 Fillable Alanna Melisa, The social security wage base limit is increased from $160,200 to $168,600. Form 8802, application for u.s.

Source: www.realcheckstubs.com

Source: www.realcheckstubs.com

How to Generate and File IRS Quarterly Federal Form 941, Employers must file this irs form by july 31. Irs form 941, employer’s quarterly federal tax return.

Connecticut, Delaware, District Of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Maine.

Employers must file this irs form by july 31.

Find Mailing Addresses By State And Date For Form 941.

According to the new updates, form 941 has few major changes.

Category: 2024